Since the beginning of the pandemic, Hubspot has been releasing weekly data on core performance metrics of 70,000 businesses to provide companies with useful benchmarks as we adapt to new circumstances that were changing by the day. Let’s take a look at the data.

Business is Bouncing Back

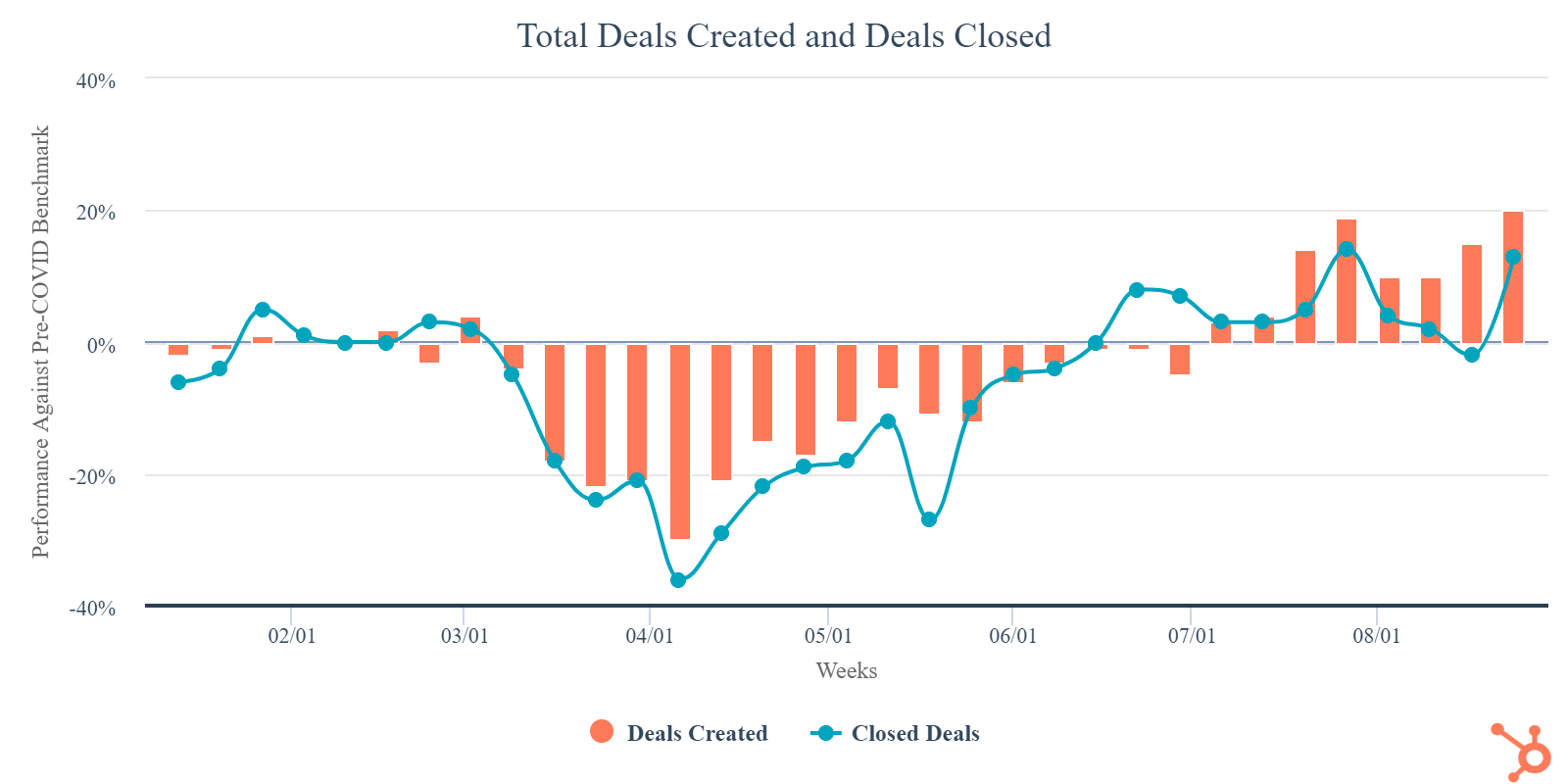

As we move into the second half of 2020 and the world begins to open up, so do the deals. There has been a steady increase in Q3 in both potential deals and closed deals as people get back to work.

Industries performing above pre-COVID benchmarks:

- Construction: 24% above benchmark

- Computer software: 14% above benchmark

- Manufacturing: 13% above benchmark

- Consumer goods: 8% above benchmark

Industries performing below pre-COVID benchmarks:

- Human resources: 20% below benchmark

- Entertainment: 21% below benchmark

- Travel: 29% benchmark

Business is getting back to normal.

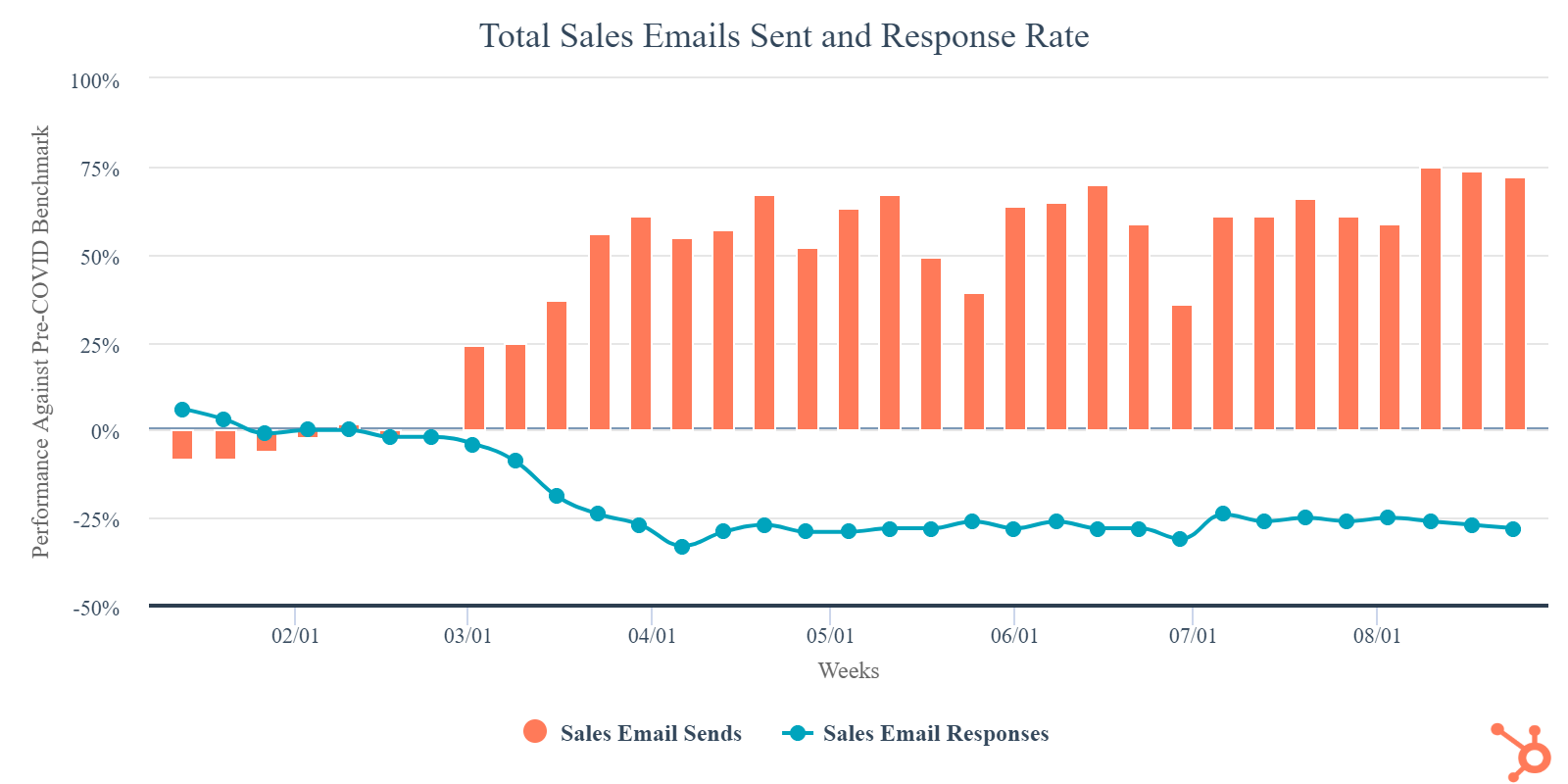

Sales eMail is Not Effective

As sales teams turn digital, recipients are being bombarded by sales emails and are ignoring them or marking them as spam.

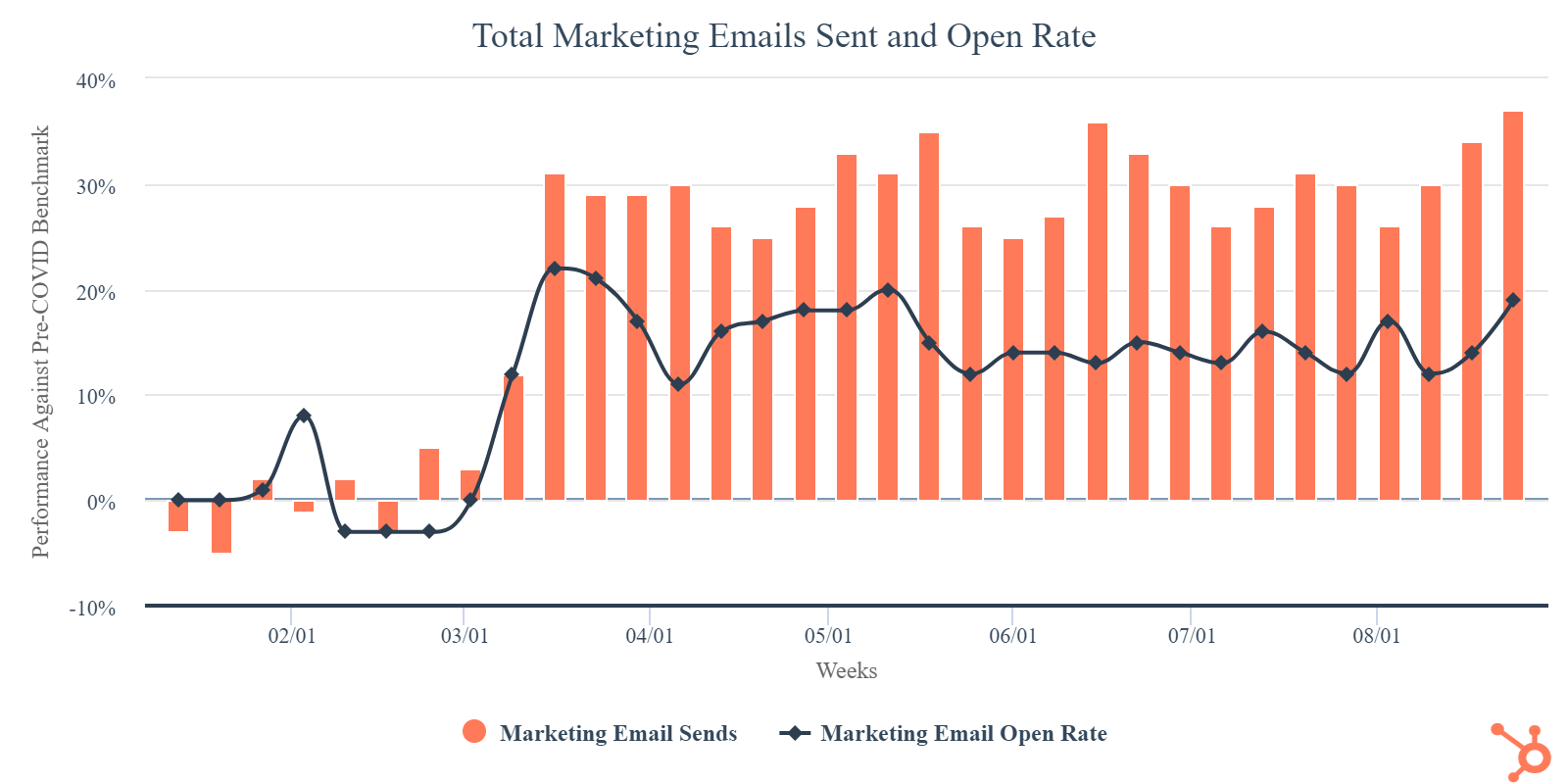

Buyers are Engaging with Marketing eMail

This elevated volume is the basis for one of the most surprising findings — open rates for marketing emails have not only remained steady relative to the increased send volume, they have actually gone up. Even as open rates reached unexpected highs, companies that sent less email got more opens. Buyers still wanted to engage and learn.

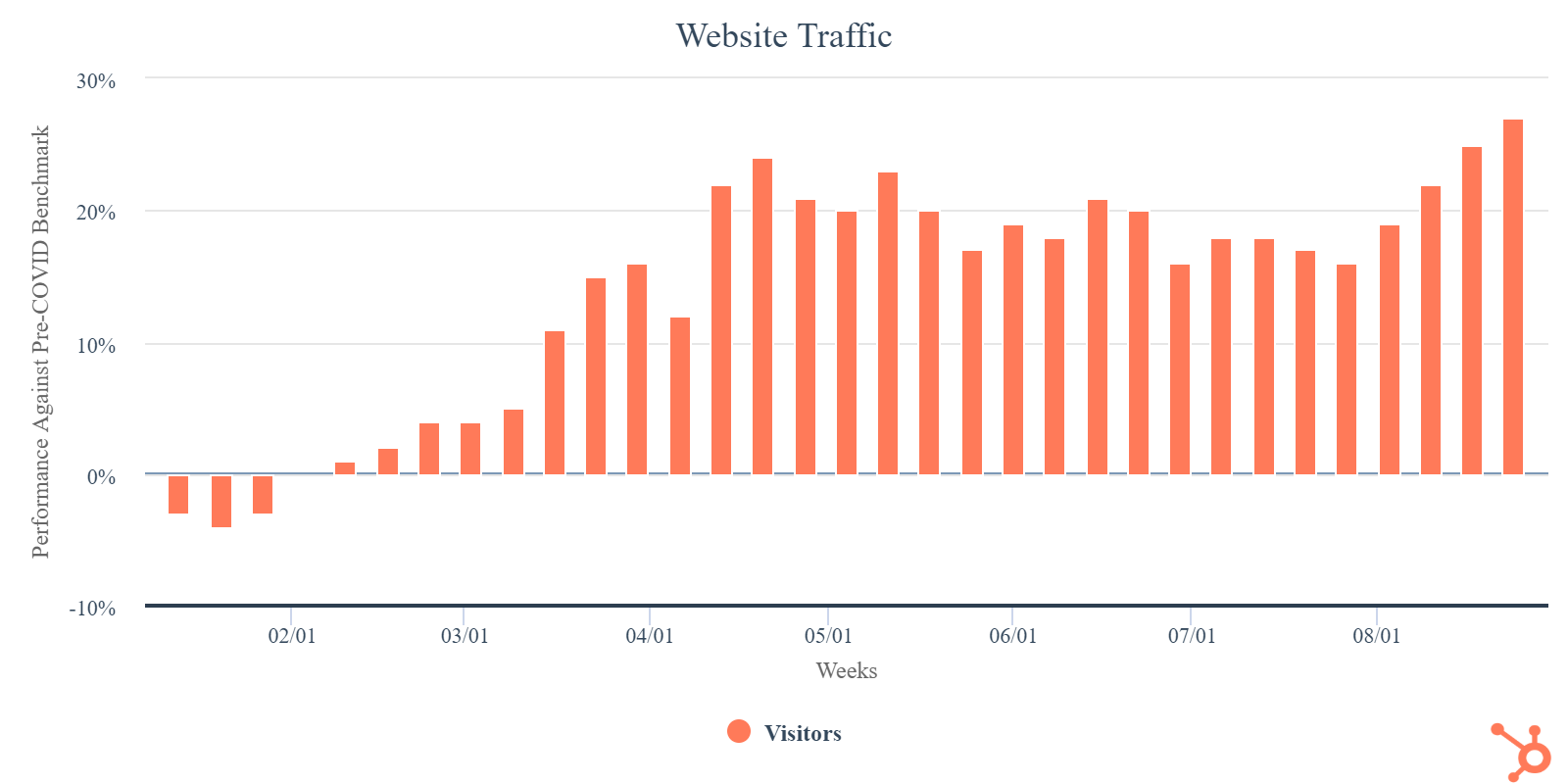

Website Traffic Grows

Website traffic has been one of the strongest-performing marketing metrics. As buyers have moved their purchasing online out of necessity, businesses with an established digital presence have reaped the rewards. Global site traffic increased by 16% during Q2 compared to Q1 currently sits at 25% above the pre-COVID benchmark.

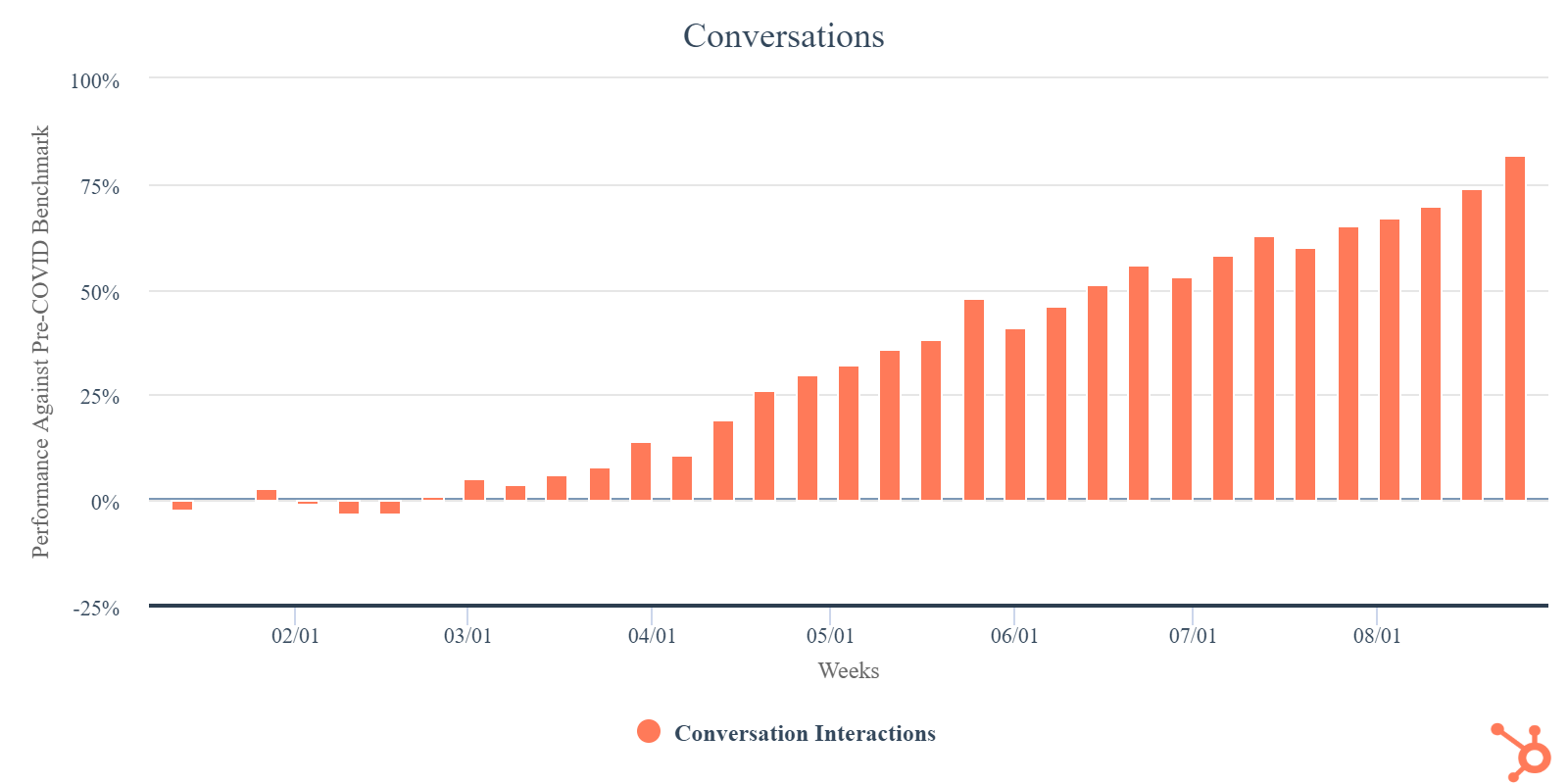

Online Chat for the Win

Online chat volume in Q2 outpaced Q1 by a notable 31%. As restrictions on businesses continue to be lifted around the world, it'll be interesting to see if chat volume maintains this steady growth.

Every industry is trending above the benchmark when it comes to live chat. This is a positive sign that buyer interest is increasing, and that people are engaging with companies more frequently.

Key Takeaways

- Align Marketing and Sales - Standard sales tactics are not getting the usual results, however marketing email, websites, and online content assets are still outperforming pre-Covid levels. Using automation software, marketing can help sales by further qualifying prospects and helping those prospects become more sales-ready.

- Invest in Chat - Live chat numbers have skyrocketed, particularly in a few industries like construction, consumer goods, and manufacturing. Chat is a way to capture the significant uptick in online buyer interest and it's also a long-term play to help scale your business. Even simple chatbots can take the manual work of basic qualification screening, meeting booking, lead routing, and simple customer service tasks off your team’s plate, leaving them free to focus on higher-value activities.

- Invest in Discoverability - Huge numbers of businesses and buyers shifted online out of necessity, many for the first time. Businesses that already had an online presence in March were at an advantage. Whether it's through a website, a landing page, or a business run through social media, buyers need to be able to find you online. Prioritizing relevant and helpful content, investing in SEO, or taking advantage of a cheaper-than-usual ad marketplace, are just a few of the many options you have to reach the right buyers at the right time.